Posted on Friday, 6th March 2026 by Dennis Damp

Print This Post

Print This Post

The start of March 2026 has brought significant turbulence for federal employees, characterized by a shrinking workforce, increased health care costs, and ongoing battles over union representation and civil service protections. Following the implementation of the 2026 benefits, employees are navigating the realities of a 1% pay raise alongside double-digit increases in health premiums, while the administration pushes for further organizational change.

Inflation at Work

2026 Pay and Benefits Reality

The 2026 General Schedule (GS) pay raise, finalized by the administration at 1% across-the-board, took effect in January. This raise represents the smallest increase since 2021 and applies to most federal employees, with no additional locality pay adjustments.

Concurrently, FEHB (Federal Employees Health Benefits) premiums for 2026 increased by an average of 12.3% for the employee/retiree share. This marks the second consecutive year of double-digit hikes. Notably, the new 2026 rates also include higher out-of-pocket maximums ($10,000 for self-only) and a $ 17.90-per-month increase in the standard Medicare Part B premium, rising to $202.90.

Workforce Reductions and Agency Developments

A major theme this week is the continued focus on decreasing the federal headcount. Data released by the Office of Personnel Management (OPM) indicates that the civilian workforce shrank by 12% between September 2024 and January 2026.

The Office of Personnel Management (OPM) continues to reshape federal workforce accountability, and agencies are prioritizing employee performance over time-in-service when initiating RIFs. The administration is focusing on performance standards and limiting the number of outstanding ratings awarded throughout the government. There is a sustained shift toward a more realistic evaluation process as OPM heads into the next fiscal year.

Reports from early March 2026 indicate that the administration is moving forward with plans to dismiss thousands more federal employees, particularly those involved in diplomatic and national security operations. The administration is also advancing plans to reclassify thousands of career civil servants into a new “schedule policy career” designation, which would remove their appeal rights for adverse actions.

Senate Fails Again to Advance DHS Funding

In Congress, efforts to break the impasse over funding the Department of Homeland Security (DHS) stalled once more. This marks the third week of unsuccessful attempts to move the bill forward.

Lawmakers returned from recess without a breakthrough on immigration‑related reforms tied to DHS appropriations, leaving the department and its sub-agencies—including TSA, FEMA, and the Coast Guard—without full funding. The stalemate underscores the broader political divide over border and immigration policy, which remains the central obstacle to reopening the shuttered parts of the government.

Performance vs. Tenure in RIFs

OPM is pushing for new regulations that would change how agencies conduct Reductions-in-Force (RIFs). The proposal seeks to prioritize performance over seniority (tenure) when determining which employees are retained or removed, a move expected to be finalized soon.

Union Battles and Litigation

Unions, including the American Federation of Government Employees (AFGE), are actively fighting to restore collective bargaining rights and combat the administration’s “union-busting” orders. A significant legal development this week saw a federal judge allow a lawsuit to proceed against the Department of Government Efficiency (DOGE), alleging that its data access violated the Privacy Act.

Tax Updates

The tax changes from the Tax Cuts and Jobs Act (TCJA) were made permanent this year, preventing tax hikes for roughly 62% of filers. Other changes include:

- Up to $25,000 in tips and $12,500 in overtime can be deducted, with income limits ($150k single/$300k married).

- The standard deduction for 2026 rises to $32,200 for married couples filing jointly and $16,100 for single taxpayers.

- The Child Tax Credit expanded to $2,200 per child for qualifying taxpayers.

- An additional $6,000 deduction is available for taxpayers 65 and older.

- Deductions for interest on loans for American-made vehicles, up to $2,200 for eligible couples.

- Business tax cuts permanently restore 100% bonus depreciation and the 20% pass-through deduction.

The IRS also announced that the mileage reimbursement rate for federal employees using personal vehicles for official purposes increased to 72.5 cents per mile.

Conclusion

Things are happening at lightning speed these days, especially when you add in the Iran conflict that took center stage all week. There isn’t a day that goes by that something new doesn’t grab our attention, all the while not giving us a chance to digest what happened the days before. The frenetic pace of it all has numbed many to the onslaught of news these days.

I’m starting biweekly Federal Employee News updates to capture much of what is going on by providing a brief summary that can be explored in more detail if desired. The shift from one major news release to another can happen overnight. Soon after, the previous hot topic is sidelined, only to circle back to bite us one way or another.

Helpful Retirement Planning Tools

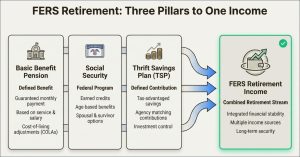

- Financial Planning Guide for Federal Employees and Annuitants

- TSP Guide

- Budget Worksheet

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- 2026 Federal Employees’ Leave Chart

- Medicare Guide

- Social Security Guide

The information contained herein may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult a financial, medical, or human resource professional where appropriate. Neither the publisher nor the author shall be liable for any loss or other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Tags: 2026 Pay Raises, 2026 Tax Breaks, Civil Service Unions, Daily Brief, DHS Funding, FEHB, Performance based RIF selections, RIFs, Workforce Reductions

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, General Information, OPM UPDATES, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION

Comments (0)|  Print This Post

Print This Post